tax abatement definition for dummies

To estimate the market value of a property in eminent domain proceedings To estimate the market value of a property in contract disputes or as part of a portfolio To estimate the market value of partnership interests To estimate damages created by environmental contamination To estimate assessed value. What Does Tax Abatement Mean.

West Midtown S Interlock Project Could Claim Another 5 4m In Tax Abatement Eco Architecture Urban Design Concept Urban Concept

Check out our property tax calculator.

. Some cities introduce property tax abatement to homeowners. Tax abatement synonyms tax abatement pronunciation tax abatement translation English dictionary definition of tax abatement. Tax abatement n Steuernachlass m.

The benefits of the tax abatement are then passed on to owners or renters who eventually purchase or rent property within the building. It can be for either individual consumers or companies. More from HR Block.

Also known as a tax holiday it is the temporary elimination or reduction of tax. A city grants a tax abatement to a developer. It is offered by entities that impose taxes on property owners.

The term abatement refers to a situation where an economic burden is reduced. The development is eligible for a 10-year property tax abatement. Abatement of tax refers to a reduction in or reprieve from a tax debt or any other payment obligation.

You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations due to circumstances beyond your control. For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would. How Does an Abatement Work.

Governments sometimes introduce it to encourage economic development. They wont completely eliminate your property tax. There are many examples of this type of tax break.

Tax abatement represents a taxation level reduction. A sales tax holiday is another instance of tax abatement. Tax-abatement meaning Meanings A temporary suspension of property taxation generally for a spe-cific period of time.

An abatement is a reduction in a tax rate or tax liability. IRS Definition of IRS Penalty Abatement. The government can fund a project by pointing to the revenue the project will generate once its complete.

For example John Doe owns a house and owes 4000 in property taxes for the year. This period is typically extended to between 5 and 10 years. A tax abatement is a financial incentive that eliminates or significantly reduces the amount of taxes that an owner pays on a piece of residential or commercial property.

A taxpayer seeking abatement of taxes assessed on property has the burden of proving the disproportionate payment of taxes by a preponderance of the evidence. A reduction of taxes for a certain period or in exchange for conducting a certain task. Tax abatements help reduce the initial costs of opening a business.

You may wonder just what the one-time Tax Penalty Abatement program entails. An amount by which a tax is reduced. It reduces or completely eliminates the tax on the commercial or residential property.

The IRS grants abatement or tax relief only to taxpayers who have proven reasonable causes behind a penalty despite tax trouble. These organizations include municipalities state treasury offices city governments and the federal government. In essence this program is a reprieve that allows you to escape the penalties levied against you because of not filing or failing to pay your taxes.

Some organizations offer tax abatement on the properties. This burden might take the form of a debt an import tariff a tax a fine a penalty or a reduction of the percentage being charged like an interest rate or a tax bracket reduction. Penalty abatement removal is available for certain penalties under certain circumstances.

Without tax abatement I will never get the loans to finance the project. Tax abatement is a financial incentive for the buyer. An abatement may occur after a natural disaster such as a devastating earthquake flood or hurricane.

Tax abatement is a kind of relief the IRS grants to taxpayers who exert effort to comply with the law but are unable to fulfill their tax obligations because of uncontrollable events. Governments use abatements as an economic development tool. Who Receives a Tax Abatement.

For example a tax abatement may be given to a developer or building owner who builds or makes improvements to buildings in certain areas. Tax abatement noun C or U TAX FINANCE PROPERTY uk us a reduction in the amount of tax that a business would normally have to pay in a particular situation for example to encourage investment. Essentially it means banking on the increase in property tax revenue that will result when the project is finished.

They are granted by the city and can provide full or partial relief from property and other taxes for a specified period of time. Property taxes are a common subject of abatement though the term is often used when discussing overdue debt. They could be in the form of a rebate reduction in tax penalties or an actual tax decrease.

The word abate means to reduce in value or amount So a tax abatement is simply a lessening of tax. Definition of tax abatement. Sometimes people or firms pay too many taxes or get a tax bill that is higher than it should be.

Tax abatement programs reduce or eliminate the amount of property tax owners pay on new construction rehabilitation andor major improvements. One method is called tax increment financing.

The Difference Between Tax Abatements And Tax Exemptions Propertyshark Real Estate Blog

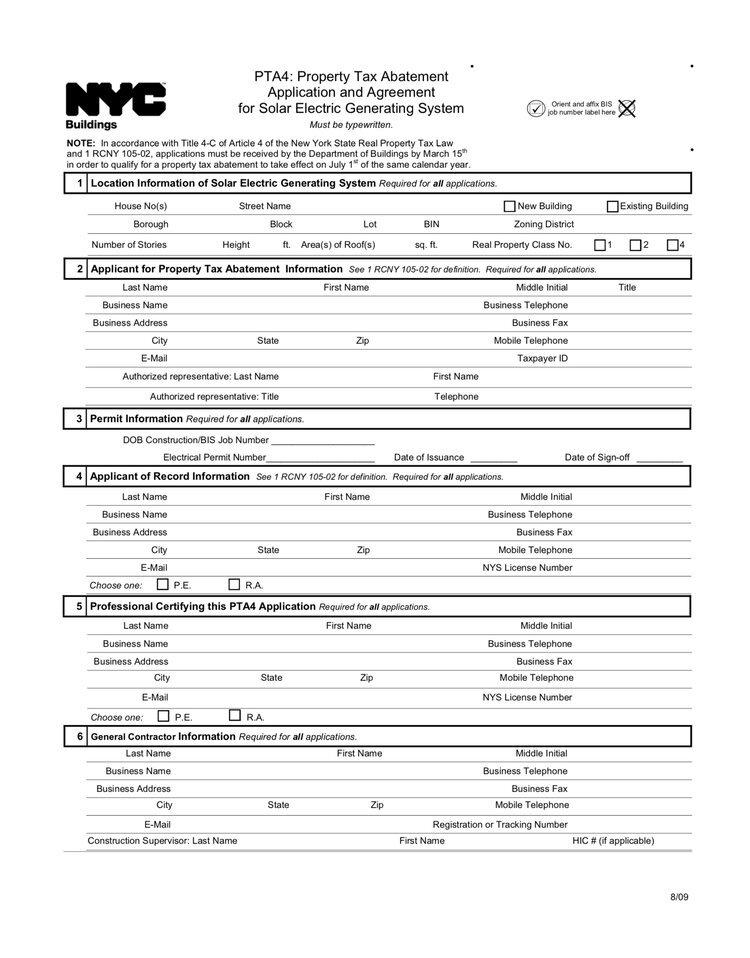

Property Tax Abatement Program

Nyc Solar Property Tax Abatement Pta4 Explained 2022

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

A Solar Powered Home Will It Pay Off Property Tax Mortgage Lenders Top Mortgage Lenders

.png)

Property Tax Abatement Program

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

How To Manage An Unexpected Tax Bill

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is Tax Increment Financing Tif The New School Scepa

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo